| Bookmark Name | Actions |

|---|

Introduction

The term Credit Limit refers to the maximum amount of credit a financial institution extends to a customer. A lending institution extends a credit limit on a line of credit. Usually, the lenders set the credit limits based on information in the application of the person seeking credit, that is, borrowers. Credit limit is one of the factors that affect the consumers' credit scores and can impact their ability to get credit in the future. A lender generally gives lower-credit limits to high-risk borrowers because they may not be able to repay the debt. Low-risk borrowers usually get higher credit limits, giving them higher flexibility to spend.

The limits are determined by banks, alternative lenders and credit card companies based on the information related to the borrower, such as

- Borrower's credit rating

- Personal income

- Loan repayment history and other factors

The line of credit is the maximum amount of money a lender allows a borrower to spend on a revolving or non-revolving credit limits.

The Limit (LI) module provides the credit limit or line of credit in Temenos Transact. All the business applications in Temenos Transact refer to the LI module for creation and maintenance of the line of credit facility applicable to the business scenario.

Product Configuration

Credit limits are held by customer and product. Simple limits can be defined for a single customer and single product. However, more complex limits can also be configured with multiple levels.

Limits are held by the customer at two levels:

- Individual

- Liability group

Also, limits can be held by the product as 12 levels:

- 10 levels of sub-product

- Product

- Global

Thus, an individual trade can be updated as six limits.

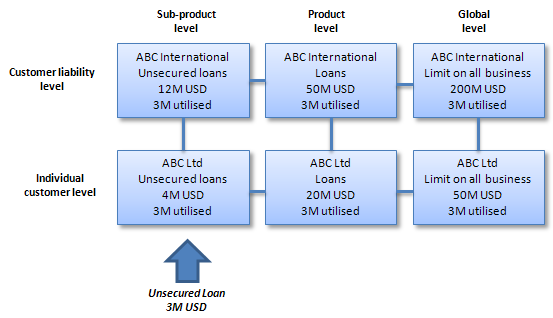

In this example, bank provides an unsecured loan to ABC Ltd of 3 million USD. ABC Ltd is a part of the larger group, ABC International. Bank monitors the limits at both company and group levels. Unsecured loans are a sub-product within loans and the limits are monitored at both levels. Finally, the bank sets a limitation on all business with ABC Ltd and with ABC International, and these limits are held at the global-level.

Consequently, the unsecured loan has updated six limits. If any limit is exceeded, an override is raised during the input of loan.

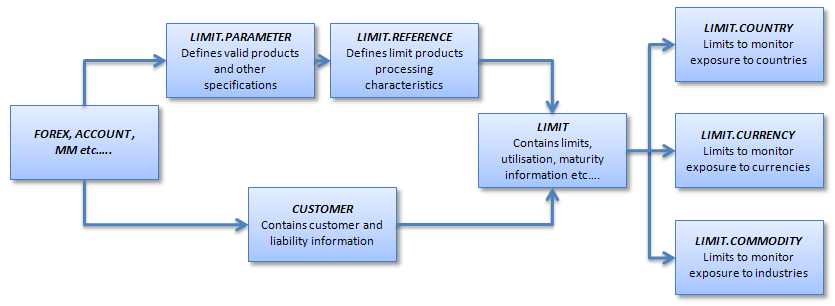

LIMITapplication holds the credit limits.LIMIT.REFERENCEapplication holds sub-products, products and global definitions.CUSTOMERapplication holds the customers and customer liability definitions.LIMIT.PARAMETERapplication defines the various high-level parameters regarding the application. It links contracts and accounts toLIMIT.REFERENCE.

The main limit parameters are shown in the below flowchart.

Limits can also be set to monitor the exposure against currencies, countries and industries. These limits are monitored overnight. The LIMIT application uses the parameter and product tables to define the structure of limits.

LIMIT.PARAMETER

This application defines the parameters that determine the way in which the limit system operates. LIMIT.PARAMETER record can have the ID as ‘SYSTEM’. The LIMIT.PARAMETER application controls the following:

- An indicator to specify if the foreign exchange contracts must be netted before limit comparison.

- A 'number of days' to define how many days prior to Limit Expiry Date and Review Date (can be fixed in the Review Frequency field) in the

LIMITapplication, the approach of these events must be reported. - A date and cycle to indicate when the first revaluation occurs and at what frequency thereafter.

- A date and cycle to indicate when a central liability report (including those liability numbers which did not move) must be produced in the back-end process.

- A date and cycle to indicate when the commodity, country and currency reports must be produced.

- A ‘number of days’, administrative Extension Days, define the maximum number of days by which the expiry date of a limit can be ’administratively’ extended before a new expiry date must be assigned to the limit.

- The LIMIT application is defined according to the specific requirements of the bank. The most important feature of this application is that it allows the bank (for each financial application) to define the precise rules applicable to an environment. In this way, the limit verification process can be established by the bank according to a bank’s own set of rules without any program maintenance.

The product group definition that allows the bank to specify the different products, (in bank’s opinion) must be part of the commodity, country and currency exposure.

Creation of Other Record IDs:

The LIMIT.PARAMETER application allows the creation of other record IDs besides SYSTEM. These record IDs can have a valid legacy application (that is, ACCOUNT, LD, MM and FOREX) as ID. The purpose of these records is to move their parametersation, which was initially done in the SYSTEM record, to new individual records for each application to improve system performance.

For example, for the ACCOUNT application, the user can create a new record, which includes all the necessary parametrisation for this particular application.

Illustrating Model Parameters

This section covers the high-level specification required for Limits (LI) module.

Illustrating Model Products

The following are few examples of the LI products in the LIMIT.REFERENCE application.

| S.No. | Products |

|---|---|

| 1. | Advances for Current Account |

| 2. | Loans Secured |

| 3. | Loans Unsecured |

| 4. | Commercial Loans |

| 5. | Term Loans |

| 6. | Project Finance Secured |

| 7. | Project Finance Unsecured |

| 8. | Packing Credit Secured |

| 9. | Packing Credit Unsecured |

| 10. | Bills of Exchange |

| 11. | Securities |

| 12. | Facility Limit |

| 13. | Packing Credit |

Add Bookmark

save your best linksView Bookmarks

Visit your best links BACK

BACKIn this topic

Are you sure you want to log-off?